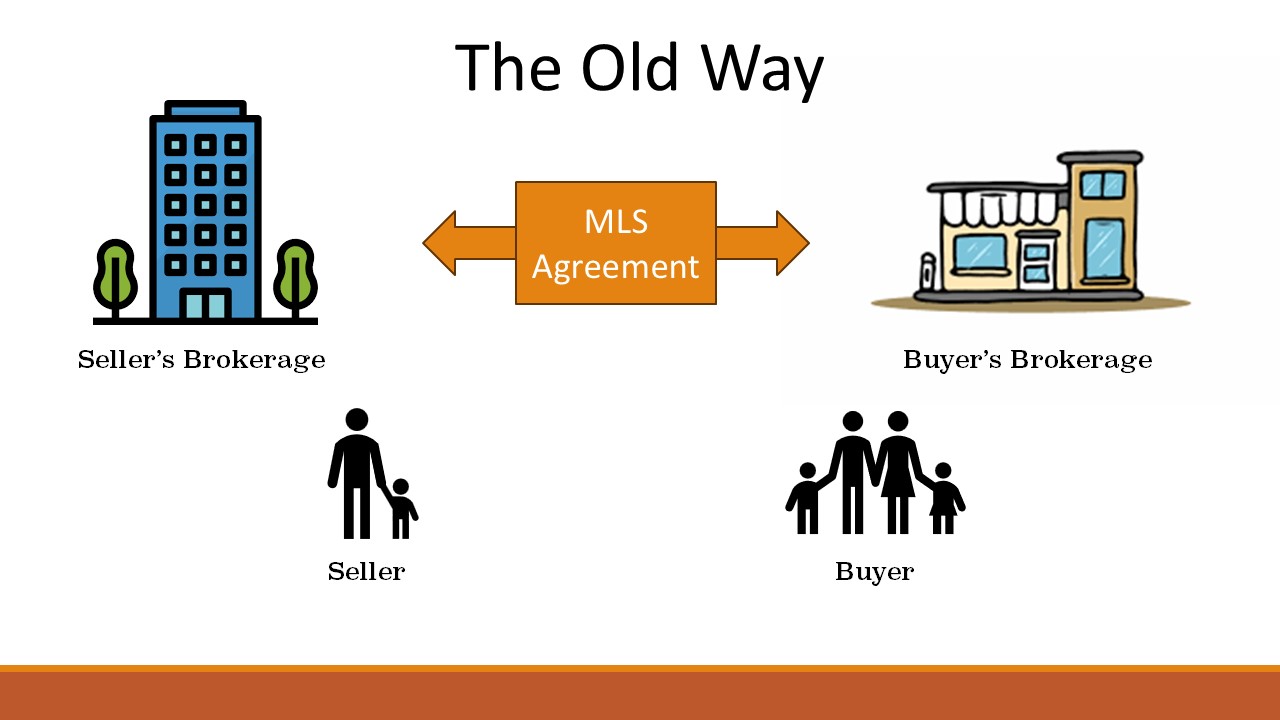

Here is a 10 minute summary of the NAR lawsuit and the new procedures that Agents need to do to hopefully kind of condense it down for a real quick, “here’s what it means and here’s what you do.” Here’s the old way that we used to do commission sharing with Brokerages is we used to have the Seller’s Broker and the Buyer’s Broker agree that if they were members of the Multiple Listing Service that the Seller’s Brokerage would offer a Buyer Agent commission to the Buyer’s Brokerage and then any property that they sold through the multiple listing service they already agreed that whatever the offer of commission sharing was was what the Buyer Broker would get, and that’s how it would work. That’s the way we used to do it.

Here’s the old way that we used to do commission sharing with Brokerages is we used to have the Seller’s Broker and the Buyer’s Broker agree that if they were members of the Multiple Listing Service that the Seller’s Brokerage would offer a Buyer Agent commission to the Buyer’s Brokerage and then any property that they sold through the multiple listing service they already agreed that whatever the offer of commission sharing was was what the Buyer Broker would get, and that’s how it would work. That’s the way we used to do it.

BAC Determined By Seller’s Broker

Now with the lawsuit there’s a few potential problems that they’re trying to alleviate or solve, mostly for Buyers. Some of those include things like the Buyer-Broker commissions were being determined by the Seller’s Brokerage. The Seller would agree to pay a certain amount to the Buyer’s Agent through the Listing Agreement. In fact, it wasn’t long ago that many Multiple Listing Services required the Seller’s Brokerage to include an offer of Buyer Agent Commission (BAC) in order to list. That kind of made it difficult for the Buyer to negotiate their commission with the Buyer’s Agent if there was already an offer of compensation from the other side.

Also, often it was found that Buyers’ Agents would just accept whatever the Seller’s Brokerage offered, even if it was lower. For example, if they agreed to 3% with their client, but then the Seller’s Brokerage only offered 2.5% or 2%, a lot of times the Buyer’s Broker would just accept whatever that lower offer of commission was, regardless of what their original agreement said. Or if it was higher, they would do the same. And you can see if they’re accepting a higher amount, you want to know who’s paying for that, right? It’s the Buyer and the Seller that are paying for that, either the Seller from their proceeds through their Brokerage or the Buyer because they’re paying for the cost of the property. So if a Buyer’s Brokerage was accepting additional compensation over and above what their original agreement was, you can see how that kind of creates a conflict of interest, and it creates a question about loyalty to their client.

That was one of the potential problems that they’re hoping to solve with this lawsuit. Also, the question of when the Buyer’s Agent and the Seller’s Agent are cooperating about the payment itself, then who are they serving really?

Agents Steering Clients on BAC

There are even more loyalty questions. There’s been a culture in the real estate market of Agents who either prided themselves on offering a high Buyer-Agent commission to Buyers’ Agents and sometimes potentially steering Buyers based on that, or Buyers’ Agents who if they agreed on a certain amount of commission with their client and then properties didn’t offer enough to cover that, that they might steer their clients away from properties who didn’t offer that. If they communicated that clearly, that’s better, but it’s still not as good as if they would work to get their Buyer whatever property was best for them, regardless of whatever Buyer-Agent commission was offered. You would want to find a solution that was best for your Buyer.

Hidden Costs

And then another problem that was happening is that the costs were kind of hidden from the Buyer, where those Buyer-Agent commissions used to be only shared between Agents and the public couldn’t see it on the Multiple Listing Service and so they didn’t know what was out there.

They could only find out if their Agent told them directly. And then recently we changed that so it was public so anyone could see that, but that still created kind of an environment where that was already fixed. And so if you had a Buyer offer of compensation different from the Buyer-Agent agreement, that still can create a conflict of interest that had to be resolved. And so in order to make that clearer for everybody, this settlement intends to spell out how much everyone is getting paid directly in the agreements.

Anything that makes the Buyer have more clarity about their transaction and understand more of what they’re paying for and the services that they’re getting in exchange for their payment, is better for everybody. Hopefully that will be the outcome of the settlement.

The NAR Settlement Summarized

So what is the settlement? It’s basically these three things.

- Realtors® cannot advertise Offers of Buyer Compensation (BAC) on the Multiple Listing Service (MLS)

- Buyer Agents cannot accept any payment for their services that is greater than listed in their Buyer Broker Agreement

- Realtors® cannot show or tour property with a buyer unless they have an agreement with that buyer, with clear compensation, and clear explanation of services

Number one is that we can no longer offer a Buyer-Agent-commissioned sharing on the multiple listing service. We just can’t do it. That probably means also that you can’t set up another service that’s not the MLS but still is a big repository of Buyer-Agent commissions. If it’s all listed in one place, that’s going to be considered potentially a multiple listing service, so we can’t put those on there.

We can still offer BAC, Buyer Agent commission from the Seller Brokerage to the Buyer Brokerage, but it just can’t be listed on the multiple listing service. That’s number one. That’s the one main point.

Number two is that the Buyer Agent cannot accept any more payment than their Buyer agency agreement states. Now hopefully if you were representing your client right and loyally that you wouldn’t have done that in the first place. If there was a larger offer of compensation you would have negotiated that in favor of your client. This spells out specifically that you cannot accept any compensation greater than your Buyer agency agreement if you represent the Buyer. Very clear.

Number three, you must have an agreement before showing homes, before any home tours. That wasn’t common practice in Utah, but now according to the settlement, any members of the Association of Realtors have to have an agreement before home tours. Now it doesn’t specify how much agency has to be in that agreement, but it does have to be clear about the compensation that’s offered, and it has to be clear about the services that you’re giving.

Those are the three main points of the settlement. That’s it. That’s what you need to understand. Okay? Kind of simple. It may get a little more complicated in the implementation.

3 Ways for Buyer Broker to Get Paid

So let’s look at how a Buyer Broker might be paid under this new agreement now that the multiple listing service agreement that was in place before is no longer there.

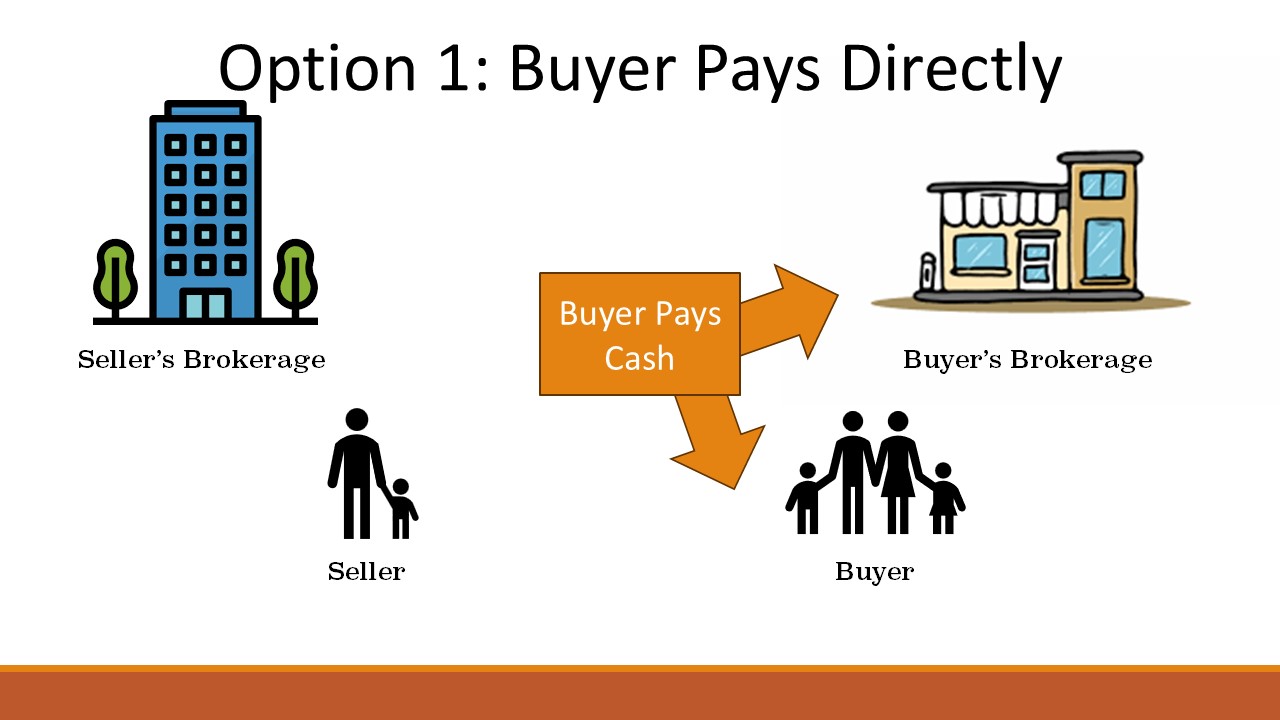

One option is of course that the Buyer can still always pay their Brokerage directly. They can pay cash, they can pay however they can, but often still you’re not able to finance that. That was one of the advantages of having the sharing commission from the Seller side is that financing does allow the Seller to pay for that through their Brokerage, but it doesn’t allow the Buyer to finance their Broker’s commission. So that’s something that we’ll have to figure out now, but in this situation it’s very clear how much the Buyer agreement is and how much they pay. That’s one option.

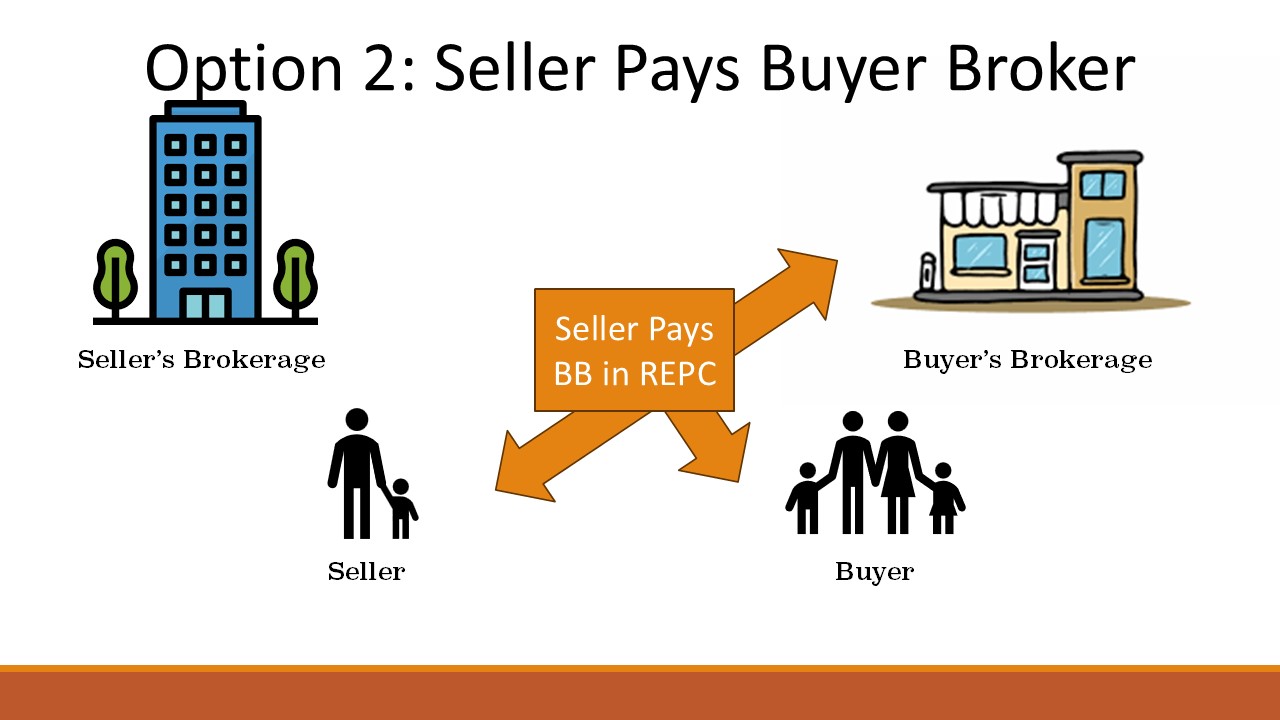

Another option is that the Buyer can ask the Seller through the real estate purchase contract (REPC) to pay their Brokerage their commission. So as part of their offer, they can say “Seller, I’m going to pay this much for the house and I want you to pay this much to my Buyer Broker for helping me find it and for facilitating the transaction.”

Now it’s very clear who’s paying and how much they’re paying. It’s right there in the real estate purchase contract (REPC), but notice here the Seller’s Brokerage is not involved in this. This is just an agreement between the Seller and the Buyer. The Buyer asking the Seller to pay something that the Buyer owes, which is the commission to the Buyer’s Brokerage. That is okay, that’s great, that’s something we can do.

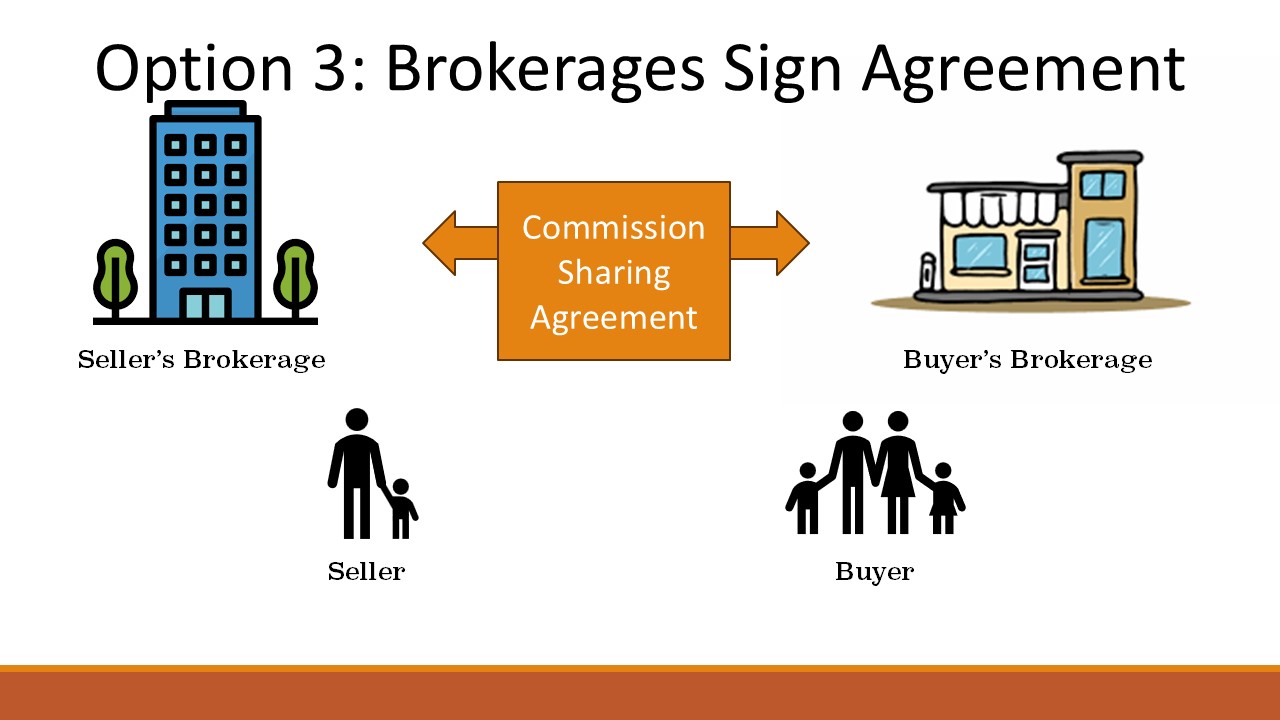

A third option is the Brokerages can still sign a commission-sharing agreement, they just don’t have that automatically through the multiple listing service. So now for each transaction that you do, you’ll have to sign a new commission sharing agreement between the Seller’s Brokerage and the Buyer’s Brokerage. If you do get that signed, then it can look a lot like it used to, where the Seller’s Brokerage agrees with the Seller that they will pay a certain amount to the Buyer’s Brokerage, and then the Buyer’s Brokerage and the Seller’s Brokerage make an agreement that they will get that paid. This way is very similar, the difference being that you don’t have that automatically with the multiple listing service. Instead, you create that agreement on the transaction itself. It creates more paperwork maybe, but hopefully it creates more clarity about what’s being paid and why it’s being paid. That’s the hope.

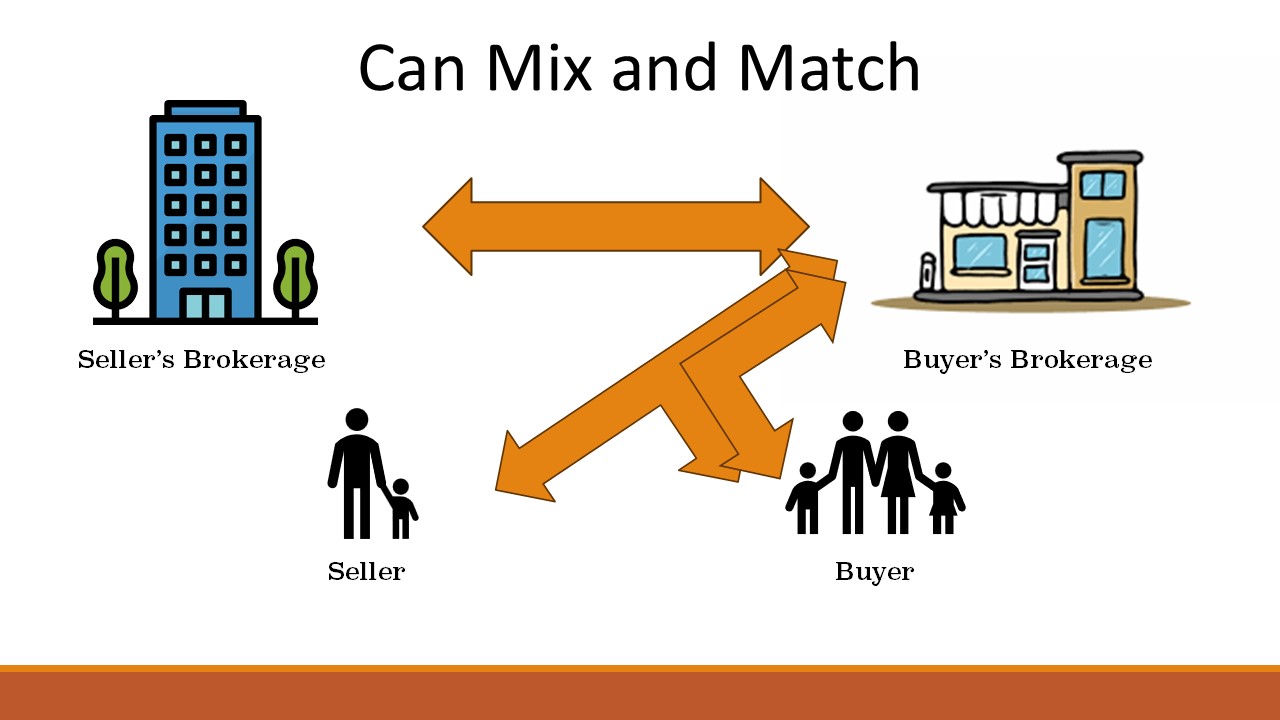

Now you can mix and match any of these. You can have the Seller’s Brokerage agree to share commissions with the Buyer’s Brokerage as long as everybody understands what’s going on. You can also at the same time have the real estate purchase contract where the Buyer asks the Seller to pay a certain amount to the Buyer’s Brokerage. That can happen at the same time. Additionally, the Buyer can still pay their Buyer Broker directly with cash or additional funds wherever they get them. They could have all three of these in place at the same time.

Now you can imagine it can get complicated with three different agreements going on at the same time, so you’ll probably want to simplify this to some degree and make it clear for everybody to understand. But you can do it all three of these ways.

Thank you UAR and MLSs

Now the Utah Association of Realtors has done a ton of great work on this. They’ve got some new forms, some new addenda that help cover these situations. And each of the different multiple listing services are creating different forms as well. If you are a member of the Utah Association of Realtors, check your email for their updated forms and explanation videos.

Hopefully with these new forms and with this new understanding of what we’re trying to accomplish we can step into this new stage of the market and we can really show our clients what we can do for them. Hopefully we’ll do another one of these videos where we sort of talk about the forms, in brief, so you can get the information nice and concise in a way that’s helpful for you to continue to serve your clients.

Watch Part 2 here: