Hello, this is Danny Naylor with the Institute of Real Estate Education. I wanted to see if we can do in 10 minutes a quick summary of the changes to the Utah Association of Realtors new forms that they have implemented to comply with the NAR settlement that’s happening. Those are implemented I think today, August 14th.

I just wanted to go over them real briefly, hopefully a 10-minute overview so you can kind of see it in a nutshell, and then maybe we’ll do another video where we cover more of the potential complications that might come up with the different ways we do things now that are different than they used to be, okay?

So if you remember the three main points of the lawsuit were:

- Cannot advertise BAC on the MLS.

- The Buyer Agent can’t accept any more payment than their Buyer Agency Agreement

- We must have an agreement before we do any home tours.

Thank you UAR

Okay, so that’s kind of a short version of the changes. So now let’s look at the forms real quick and see what they changed. So the UAR, and these are proprietary forms by the way, if you’re a member of Utah Association of Realtors you can log into one of their affiliated MLSs and get a copy of them or get them straight from UAR. They’ve done a lot of work on these and we really appreciate what they’ve done to kind of help all of us working in the industry to do things the right way and take care of our clients the best way we can.

Exclusive Right to Sell Listing Agreement

So first change I’m looking at is the Exclusive Right to Sell Listing Agreement and Agency Disclosure. One tiny change they made is they clarified at the top that the date at the top is when the agreement ends. I’ve seen some confusion about people putting a start date in there instead of an end date.

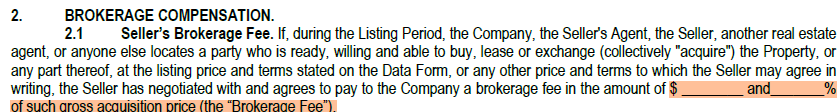

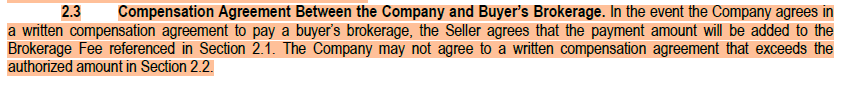

The next little change they did is they clarified that the commission here is based on a GROSS acquisition price. So not net, it says gross in the agreement now. If you want to do commission based on net, you totally can. Just do an addendum and clarify that or change it, change the section. But the current agreement now says gross acquisition price for the Seller’s Brokerage fee.

Seller’s Brokerage Commission vs Offer of Buyer Broker Compensation

Now one big change here based on these new changes is that now this portion up here is only what the seller’s brokerage will get. It is not what is being shared with the buyer’s brokerage. Okay, it used to be on the old form that up here you would put the total amount that might be shared between the two, but now you only put the amount that the Seller Agent would receive.

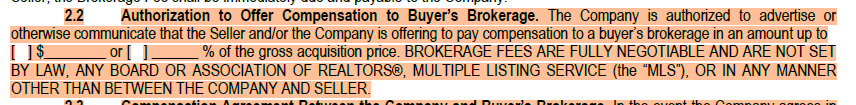

Then this new section down here, 2.2, gives the option to put in how much you would offer to a Buyer Agent if they brought a buyer here. So we can’t advertise Buyer Agent commission offers on the multiple listing services, but we can still offer those to other agents and we can still pay those, okay? But the way you do that now is you put a separate amount down in section 2.2.

So where maybe in the past you might have done like say 5% that you would split between a Seller Agent and a Buyer Agent, now instead of putting 5% in the top here you would just put the part that the Seller Agent would get under that split, so maybe two and a half if you were doing a half and half, and then the other two and a half would appear down in this 2.2 section. Now this here is not a full agreement to pay that necessarily.

MLS Commission Sharing is Gone

It used to be with the multiple listing service that the agents had all agreed already that if there was something in this contract then it would be paid. But now since we don’t have the ability to put those in the multiple listing service, now this authorization to offer compensation is just an authorization from the seller to their listing broker to OFFER compensation, but it doesn’t necessarily create an agreement between the two brokerages. So that’s kind of the change that we’ve made here to comply with the settlement.

We also say here this section in 2.3, we clarify that this does fulfill the compensation that the Buyer Agent is willing to receive. It also says here the company may not agree to a compensation agreement that exceeds the authorized amount in section 2.2, right? So this is a maximum that the seller’s broker can offer to the other side, but again this is just an offer now, it’s not a full agreement to pay that to a Buyer Broker.

Now you’d have to have a separate broker payment agreement between the brokerages because we don’t have that multiple listing service agreement where we had already agreed.

Other Changes

Okay, so that’s kind of the big change is you can still offer the compensation but now you have to create an agreement per transaction to make that happen. Okay, a couple of other little changes I noticed on this form from previous versions. Some of these might have been in there recently.

One is that the warranties, the seller warranties now specifies that they will use the UAR seller property condition disclosure, not just any property condition disclosure.

I noticed that they added a Shall or May to the dispute resolution section of this agreement, and they also added a section that says that the seller of this agreement will not enter any class action against the company here. That’s kind of an interesting addition that we did, kind of a legal protection for agents.

Those are kind of all the changes I found in the most recent form. So the big changes here are:

- The gross acquisition price is clarified to be gross.

- Seller Agent commission and the Buyer Agent commission separated into two sections of this contract

- We no longer have the multiple listing service as a agreement already in place to share commissions.

Which Form to Use for a New Listing

Okay now if you have a listing in place, if you’re starting a new listing you would use today, you would use this new agreement.

If you have an existing listing and it’s already under contract for sale, then you don’t really need to change anything. The previous terms with the commission offer in the multiple listing service would still be in effect because they were in effect when it went under contract. But if you have a listing agreement right now that is not under contract, then you need to addend it now with some of this new language.

Addendum to Listing Agreement

They now have this addendum to the Exclusive Right to Sell Listing Agreement that sort of adds some of the same language. It clarifies the same thing where it says here’s the amount the Seller Agent will receive and here’s a separate amount that the they will offer to a Buyer Agent. They separate that out to make it compliant. So any listing agreement you already have you need to sign this addendum now with your seller to be compliant.

You can find all these in the forms libraries from UAR in the multiple listing services.

You can find all these in the forms libraries from UAR in the multiple listing services.

Buyer Broker Agreement

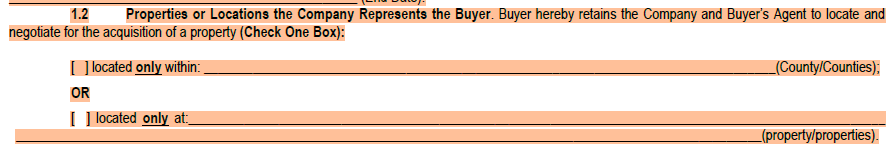

Now the Buyer Broker Agreement is a little bit similar. Remember another requirement that we have is that we have to have an agreement in place before we show properties and so one thing that we’ve added here is the ability to be more specific about which properties apply to this agency agreement.

Now there’s some question about “should I sign an agency agreement with someone if I’m just showing them the first property if they only wanted to see one house or should I just sign a showing agreement?” There are different reasons to do one or the other. The Utah Association of Realtors did not create a separate showing agreement but some of the multiple listing services have, so you can look at what options they have for that.

Specific Address, Specific Properties

The UAR buyer-broker agreement now gives the option to say that this agreement only applies to properties at a specific address. That’s what this second checkbox here under 1.2 says. They also clarified up here, that this is an end date for the contract. So you could do like a one-day agreement, you could do a one-week agreement on this agency agreement.

If you were only going to show a couple properties and the buyer didn’t want to commit to a long-term agency agreement yet, you could do that. But there’s a lot of potential liability when showing a property. Like if the property is damaged, or if something gets left unlocked, or if something gets stolen, it’s nice to have a complete agreement with the Buyer Agent who is showing the property so that they have some understanding of what they’re going to do for that buyer. Also so that they’ve vetted that buyer to know who they’re bringing into the home. It could be a really good thing to have an agency agreement before we do any showings to kind of protect property and protect people. That’s something that might be a good thing that comes out of this settlement.

If you were only going to show a couple properties and the buyer didn’t want to commit to a long-term agency agreement yet, you could do that. But there’s a lot of potential liability when showing a property. Like if the property is damaged, or if something gets left unlocked, or if something gets stolen, it’s nice to have a complete agreement with the Buyer Agent who is showing the property so that they have some understanding of what they’re going to do for that buyer. Also so that they’ve vetted that buyer to know who they’re bringing into the home. It could be a really good thing to have an agency agreement before we do any showings to kind of protect property and protect people. That’s something that might be a good thing that comes out of this settlement.

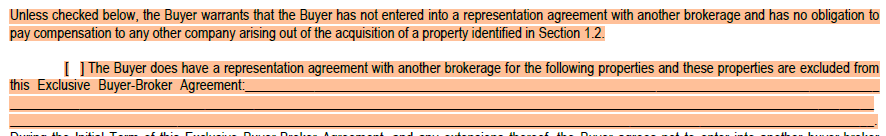

There’s also another checkbox here. Well, this sentence here says, unless checked below, the buyer warrants that they have not entered into a representation agreement with another brokerage and has no obligation to pay compensation to any other company arising out of the acquisition of the property identified in Section 1.2.

We always have had an obligation to make sure that clients don’t have another agreement, another Buyer Agency Agreement with someone else so that we don’t accidentally put them under two contracts to pay commission twice. This says exactly that, that the buyer warrants, they promise, that they don’t have another agency agreement in place. You need to make sure your buyers understand that and understand what they are signing.

We always have had an obligation to make sure that clients don’t have another agreement, another Buyer Agency Agreement with someone else so that we don’t accidentally put them under two contracts to pay commission twice. This says exactly that, that the buyer warrants, they promise, that they don’t have another agency agreement in place. You need to make sure your buyers understand that and understand what they are signing.

If they do, say they did sign a specific agreement for certain properties, and then later they come to you and want to sign for more properties or for a general agreement, then you can list here in this second check box any properties where they already have another agreement. You can still have an agency agreement with them for new properties they look at and exclude anybody that they had an agreement with on other specific properties. That way those situations are covered.

Now down here in the brokerage fee section, it says that it’s the gross acquisition price, okay, not net. You can do net, just do an addendum if you want to do that, but gross acquisition price is the default in the contract. It says that if you sign a broker payment addendum with another broker that that would satisfy this amount that the buyer owes you. It also says in bold letters the broker’s fees are fully negotiable. We want our clients to understand that.

Protection Period

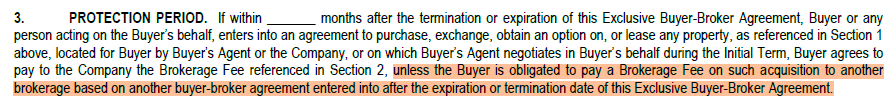

The protection period has also changed a little bit, okay? It used to be that if you had shown a property under an agency agreement and your agency expired and say you put three months in here, then for three months if somebody bought a property that you had shown them, then you would have some ability to still collect a commission on that. Now that is not always the case.

If they, here it says, “unless the buyer is obligated to pay a brokerage fee on such acquisition to another brokerage based on another buyer-broker agreement.” So that means the protection period only applies if they don’t start working with another agent. If your agreement expires and they go to buy the house without you but without any agent, that’s where the protection period would still give you room to collect a commission. But if they sign a buyer-broker agreement with another agent, then that’s it. Then they have a new agreement, your protection period is done, and they can go ahead and continue a new transaction with their new representation. This makes it very clear who they’re representing and who they have an agreement with.

They also added the shall or may dispute resolution here and they also added the sentence about the buyer cannot enter a class action against the company.

What Buyer Agreement to Use

Those are all the changes to the buyer agreement. Now similarly with this buyer agreement, if you have a buyer agreement with somebody from the past and you’re under contract for a property, you don’t really need to make any changes right now. You can just continue the contract and you should get paid normally.

If you have a Buyer Agency Agreement that you signed previously that you don’t have an under contract with, a purchase contract, then you should addend it now as of today with this addendum. And it basically just adds the legal language that complies with the settlement. So for example, it says the company may not accept total compensation from any source that is greater than the brokerage fee. That was in this original agreement here. That language is in here as well. But that means that if you, for example, agree to, say, a 2% commission from your client, and a seller offers like 4% to a buyer-broker, you’re not allowed to accept any more than the two percent. And remember when we looked at the seller agreement it said that this was an offer, it wasn’t a full agreement to pay. That’s because of the distinction between the Buyer Agent contract and the Seller Agent contract. One is an offer of what you can pay and the Buyer Broker is what you’ve agreed to actually be paid. So we’re trying to make sure that that works together.

If you’re signing a new Buyer Broker Agreement today, you would use this new form. Starting today, just use this new form. Your old ones you should addend with the new language here. Unless you are under contract, in which case you’re good to just move forward as you were. Hopefully you have printed out or made record of the Buyer Agent commission that was offered on the multiple listing service for anything that was already under contract, to make sure that you have that record and follow that through.

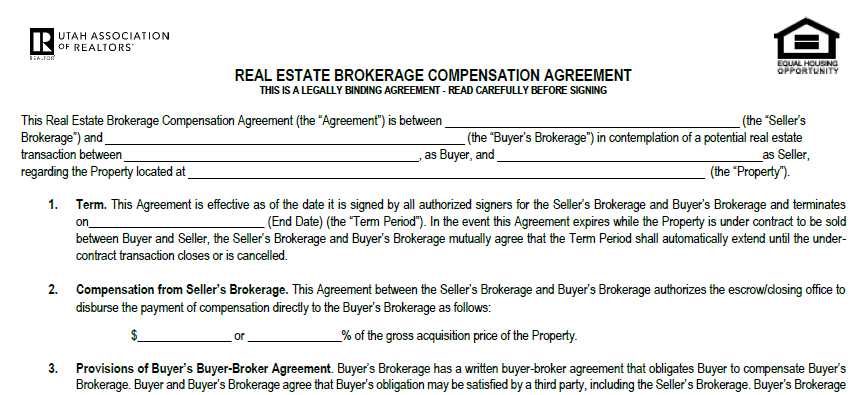

Now if you did want to have broker to broker compensation, you sign the Buyer Broker Agreement for a certain amount and the seller has offered a certain amount, that’s not a contract yet because the multiple listing service doesn’t make that an agreement anymore. If you want to get paid from the seller brokerage, now you need to use the real estate brokerage compensation agreement.

Brokerage Compensation Agreement

This is just an agreement from broker to broker, seller broker to Buyer Broker which says we agree to pay this much of the gross acquisition price to the Buyer Broker for bringing a buyer to this property. This is what you have to sign now instead of counting on the multiple listing service to already agree on the compensation.

We’ve heard people saying that seller brokerages are now asking Buyer Brokerages if they can see their Buyer Broker Agreement to see how much compensation that they’ve signed for and frankly you don’t have to show them that. The agreement between the buyer and the Buyer Agent is their property, it’s their information, they don’t have to share that agreement with the seller. In that agreement it does say that they’re not allowed to accept any higher compensation. So the Buyer Broker, when they’re signing this real estate brokerage compensation agreement with the seller’s brokerage, legally cannot write this contract for any more than what their Buyer Agency Agreement says, even if the seller was originally offering a higher compensation amount. Okay, so that’s how it has to be done now. So if you are getting paid broker to broker, then on every new contract, every new accepted Real Estate Purchase Contract, you need to get this real estate brokerage compensation agreement signed between the two brokerages.

Make sure you answer your phones and make sure that you have clear communication so that this can be handled correctly.

REPC Addendum to Pay Buyer’s Broker

There was a third way you could accept compensation, and that is if the seller pays the buyer’s broker directly, not through the seller’s brokerage. To do that, you would put it right in the Real Estate Purchase Contract (REPC). So here, there’s a new addendum to the Real Estate Purchase Contract. They are working on updating the Real Estate Purchase Contract, the REPC language itself, with the state on the approved form, but that’s still in process. We don’t know how that’ll turn out, but hopefully it’ll come out with language that’ll work for everybody.

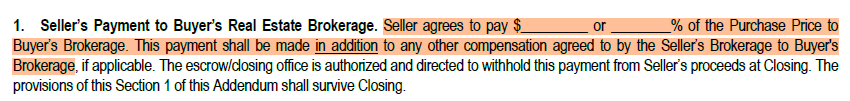

In the meantime, the Utah Association of Realtors has their own addendum for the Real Estate Purchase Contract that basically just says that the seller agrees to pay this amount of the purchase price to the buyer’s brokerage. That’s the seller paying that directly. One thing to note, though, is that this says that this payment shall be made IN ADDITION to any other compensation agreement by the seller’s brokerage to the buyer’s brokerage.

If you have a Real Estate Brokerage Compensation Agreement signed, say for 1%, and let’s say that your Buyer Agency Agreement says that you should get 2.5%, but the seller is only offering 1%, there’s another 1.5% there that the buyer will have to pay directly. Or you can potentially ask for that from the seller, and you do that with this addendum to the Real Estate Purchase Contract and you would say this says in addition so if you’re getting 1% already from the broker to broker agreement and in here you would just put 1.5% for a total of 2.5% that the Buyer Agent will be getting in the transaction.

If you have a Real Estate Brokerage Compensation Agreement signed, say for 1%, and let’s say that your Buyer Agency Agreement says that you should get 2.5%, but the seller is only offering 1%, there’s another 1.5% there that the buyer will have to pay directly. Or you can potentially ask for that from the seller, and you do that with this addendum to the Real Estate Purchase Contract and you would say this says in addition so if you’re getting 1% already from the broker to broker agreement and in here you would just put 1.5% for a total of 2.5% that the Buyer Agent will be getting in the transaction.

You can either get paid directly from the buyer with your Buyer Broker Agreement, you can get paid from the seller directly with an addendum to the Real Estate Purchase Contract, the REPC, or you can get a broker to broker compensation agreement signed between the two.

That’s our summary of the new UAR forms helping to address this issue with NAR settlement. So next we’ll look at maybe doing one more video where we’ll go through some Q&A about what situations might arise and what a real estate agent can do with the nuances between these three ways to pay and these changes based on the settlement.

Thanks for joining me and we’ll hope to see you soon.

You can read or watch part 1 here: