A new Federal Rule from the Federal Housing Finance Agency (FHFA) is set to take effect on May 1. In an effort to increase home affordability, they are making changes to the Loan-Level Price Adjustment (LLPA) matrix.

The controversy is how these changes might affect borrowers with good credit, and a reasonable down payment. Borrowers with good credit could pay up to $40 more per month on a $400,000 home with the new pricing adjustments, whereas borrowers with low credit would likely have a lower monthly payment under this rule.

When the rule is spun to the extremes, it can easily be seen as an unusual move, to raise fees on good credit homebuyers in order to lower fees on low credit homebuyers, and that is what most media reporting is using for sensational headlines. But for those who appose rules like this intended to help make homes more affordable for lower-income families, maybe we all need to evaluate the issues that it is trying to address, and see if we can do a better job helping to solve these issues.

Federal Housing Finance Agency Director Sandra Thompson said the new rules are designed to “increase pricing support for purchase borrowers limited by income or by wealth.” David Stevens, a former commissioner of the Federal Housing Administration during the Obama administration agreed there was a gap in opportunity for low-income — especially minority — borrowers to qualify for affordable homes.

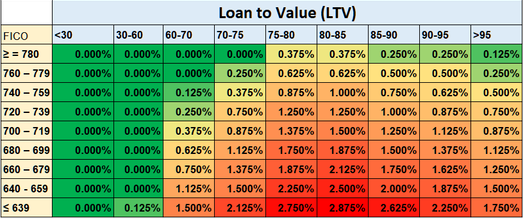

If we look at the new LLPA table, you can see that good credit is still the way to get a better rate:

While these federal rules will affect all of us, hopefully we can find ways on a local level to also help serve those homebuyers who are limited by income, and those who have been unfairly treated by market factors. If we can help make the marketplace fair for all, then it can better serve the Utah population, and hopefully affordable housing can be something we see more of for our own families and friends living in our cities and towns.

Update: The FHFA released another statement on 4/25/2023 to address these changes:

Setting the Record Straight on Mortgage Pricing: A Statement from FHFA Director Sandra L. Thompson